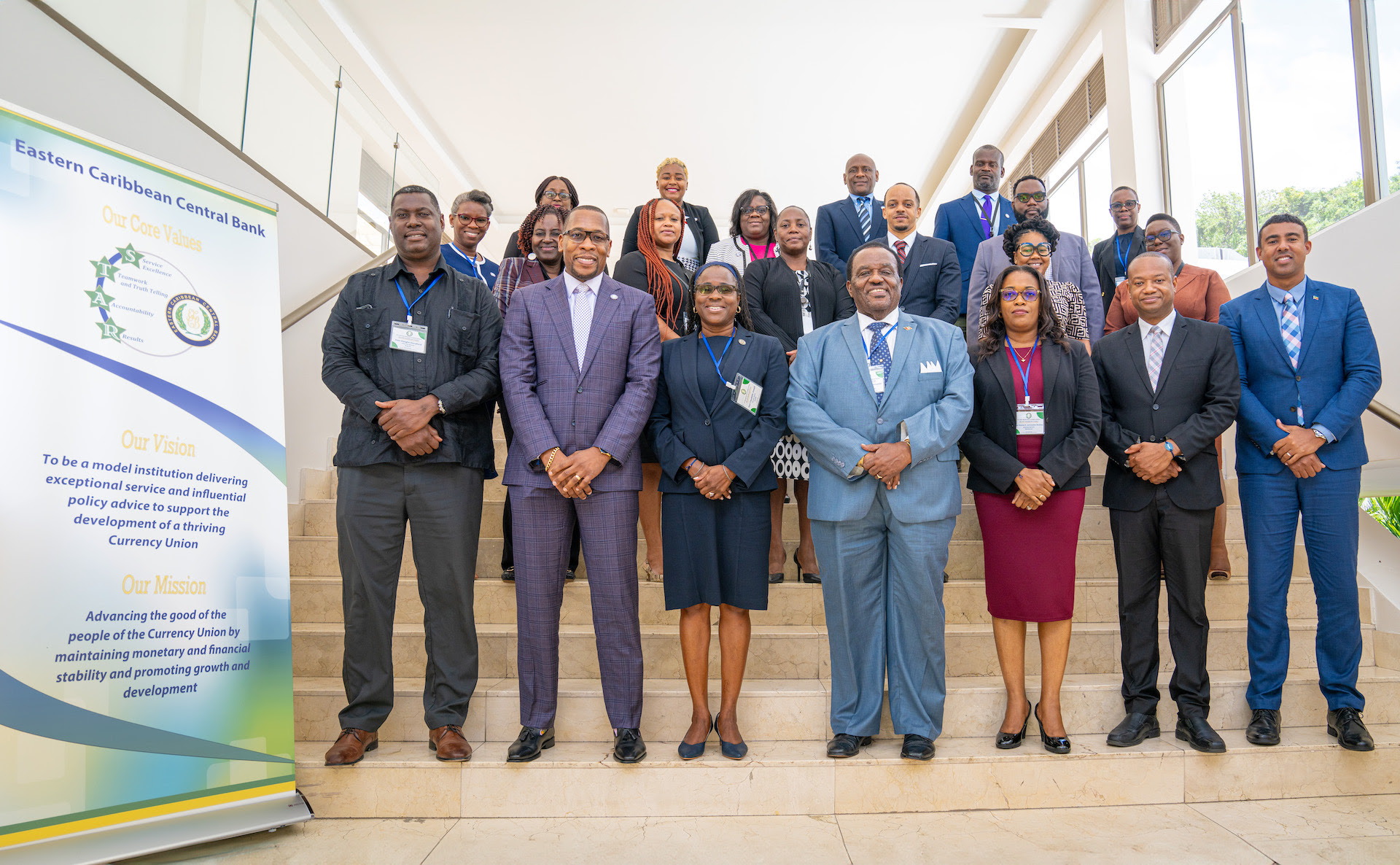

The Sixth Meeting of the ECCU Attorneys General and Chief Parliamentary Counsel convened on April 25, 2024, under the theme “Achieving Growth and Resilience – A New Vision for the Legal System in the ECCU.”

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

Chaired by the Governor of the Eastern Caribbean Central Bank (ECCB), Timothy Antione, the gathering aims to chart a course for legal reform to drive economic prosperity and societal stability across the Eastern Caribbean Currency Union (ECCU).

Garth Wilkin, St. Kitts and Nevis Attorney General, gave the keynote address and emphasized the critical role of legislative reform in creating fertile ground for economic growth and resilience in the ECCU. Attorney General Wilkin highlighted the importance of the ECCB in that process in a metaphoric example.

“Our discussion today really is about what fertilizers we, as the leaders of legislative reform, can inject into the socio-economic soils of our region for our societies and economies to not only grow rapidly but to become resilient enough to resist the external environment, over which we have little control. What the ECCB does, through strategic policy development and implementation, is provide the water to assist the process of maturity and sustainability, once the plant has sprouted. Both roles go hand-in-hand,” said Attorney General Wilkin.

Wilkin highlighted three key focus areas to achieve growth and resilience in the ECCU: digital transformation, maintenance of high ethical standards and good governance, and commitment to harmonization of laws. He underscored the importance of digital infrastructure and robust regulatory frameworks to support digital transformation initiatives, emphasizing the need for comprehensive laws on data protection, e-commerce, and cybersecurity.

On the topic of good governance, Attorney General Wilkin highlighted the Government of St Kitts and Nevis’ commitment to transparency and accountability, citing recent legislative enactments such as the Anti-Corruption Act and the Whistleblower Protection Act. He urged other ECCU member states to enact similar legislation to promote ethical standards and transparency in governance.

Regarding the harmonization of laws, the Attorney General acknowledged the progress made by ECCU member countries in implementing the Legislative Reform Programme proposed by the ECCB. However, he called for expedited passage of harmonized laws and suggested that more regular meetings of Attorneys General and Chief Parliamentary Counsel could provide a forum to address challenges and achieve consensus on proposed legislation.

In conclusion, Wilkin expressed optimism that through collaboration and proactive legislative reform, the ECCU member territories could achieve the growth and resilience needed to withstand global uncertainties. He called on is fellow Attorneys General to push for a shared vision for legal systems in the ECCU, ensuring that the ECCB’s efforts could continue to benefit the region’s socio-economic development.

The first day of the meeting concluded with a commitment from attendees to further discuss and implement the recommendations proposed by the Attorney General, with a view to fostering a more resilient and prosperous ECCU.

CLICK HERE TO GET ON THE ABN WHATSAPP

Аdvеrtіѕе wіth thе most visited news site in Antigua and Barbuda ~ Wе оffеr fullу сuѕtоmіzаblе аnd flехіblе dіgіtаl mаrkеtіng расkаgеѕ. Yоur соntеnt іѕ dеlіvеrеd іnѕtаntlу tо thоuѕаndѕ оf uѕеrѕ іn Antigua аnd аbrоаd via our One Signal push notifications! Соntасt uѕ аt [email protected].

———————————————————————

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

Make a donation to help support ABN, via PayPal: [email protected]. Follow Antigua Breaking News on X, formerly Twitter @ABNAntigua, and Instgram @AntiguaBreakingNews and on Facebook. Send us a message on WhatsApp at 1-268-779-3189 or email us at [email protected].