CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

(Observer Newsco) — A High Court judge in Antigua and Barbuda has allowed two applicants to file for judicial review challenging the Port Authority’s decision to sell the Alfa Nero. However, the same judgment gives the green light for the sale of the superyacht to continue. CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

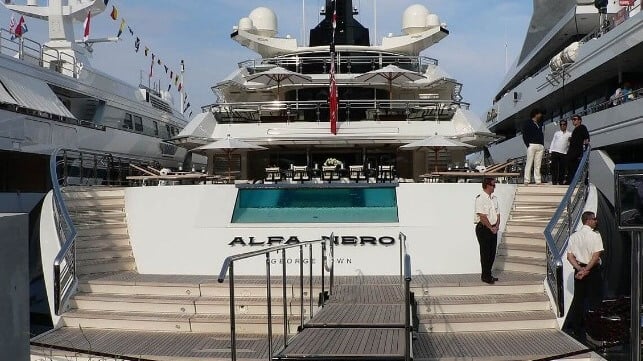

The US$81 million vessel has been in the spotlight following its entry into Antiguan waters more than a year ago.

On June 1, Ambassador to the US Sir Ronald Sanders revealed that the Alfa Nero – said to be owned by sanctioned Russian businessman Andrey Guryev – was no longer “blocked property” paving the way for its sale.

Antigua and Barbuda is keen to remove the vast vessel from Falmouth Harbour claiming it poses a threat to both its environment and other yachts, particularly as peak hurricane season approaches.

In court papers that Observer has seen, Vita Felice Ltd claims to be the owner of several works of art on board the vessel, while BVI-registered firm Flying Dutchman Overseas Ltd claims ownership of the boat.

Both entities are said to be managed by Guernsey-based fiduciary services company Opus Private Ltd and its CEO Shane Giles.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

According to the judgement, Flying Dutchman and Vita Felice applied on May 22 to prevent the sale of the Alfa Nero on several grounds including procedural unfairness and non-applicability of the sanctions.

Firstly, the applicants sought to argue that section 38A of the recently amended Port Authority Act violated their rights under the Constitution.

They also argued that the Port Authority and the government have “resolutely refused to engage at all with the company concerning the fate of the [superyacht]”, and in the interest of fairness in selling the vessel, it was required that “at a minimum there must be some willingness to engage with the owners of the vessel which it is proposed to seize and sell”.

The court papers reveal that in March attorney-at-law Justin Simon and the Opus Private CEO unsuccessfully sought to contact the Attorney General about the applicants’ ownership of the vessel prior to its sale.

It was also reported that on April 4, Giles emailed Port Manager Darwin Telemaque regarding the applicants’ claim of ownership, further advising that they were seeking the necessary licence from the Office of Foreign Asset Control (OFAC) within the US Treasury Department in order to lift sanctions associated with the vessel.

According to the judgement, Telemaque did not indicate whether he had responded to the April 4 email at the time, having reportedly said that the applicants did not request a deferral nor provided any evidence that they reached out to OFAC.

On April 8, Telemaque was reported to have responded to Giles and other persons, emailing them a notice of seizure of the vessel.

In the judge’s decision, he said that while the Port Authority Act does not “expressly impose a duty on the [Port Authority] to engage with anyone claiming to be the owner of an abandoned vessel”, “such a duty is implied in the interests of fairness”.

The judge said it was worth debating whether the Port Authority should have responded to the purported owners, stating that the evidence provided by the company that it had engaged with OFAC was insufficient at the time.

The applicants also argued that the vessel was no longer deemed to be a “blocked” property by OFAC and the CEO also questioned the nature and extent of any sanctions imposed in relation to the vessel.

The Attorney General argued on June 2 that the designation had been lifted by OFAC, but it was only to facilitate the sale of the vessel by the government.

The judge wrote that “these issues are better left to be determined at the substantive hearing of the claim”.

He also said that the issue of sanctions was relevant as it would determine whether the proceeds of any sale were to be forfeited into the country’s Consolidated Fund.

The impact of the judgement on the eventual sale of the vessel is ultimately unclear as the court has also refused to prevent the sale process from continuing.

This refusal was mainly based on the potential environmental damage and other risks posed by the vessel if left untreated or unresolved.

Port Manager Darwin Telemaque told Observer last night, “What we wanted was to liquidate the asset that was a major threat to its environment, and we have been granted permission by the courts to do so.”

Attorney Andrew O’Kola, representing the applicants, could not be reached to comment.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

Make a donation to help support ABN, via PayPal: [email protected]. Follow Antigua Breaking News on Twitter @ABNAntigua and Instgram @AntiguaBreakingNews and on Facebook. Send us a message on WhatsApp at 1-868-704-9864 or email us at [email protected].

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.

JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES: CLICK HERE.