CMC – Shareholder governments of the cash-strapped regional airline, LIAT, will meet in Barbados later on Monday to discuss the financial crisis facing the Antigua-based airline, Prime Minister Dr. Ralph Gonsalves has announced.

Gonsalves said that the “urgent meeting” to be attended by the airline’s management and the trade unions representatives, had been mandated by LIAT shareholders at a meeting held here over the last weekend.

“I have already secured the personal commitment of the three leaders of the main unions including LIALPA (Leeward Islands Airline Pilots Association), the pilots’ unions, based in Antigua and Barbuda,” he told Parliament on Monday, adding that the Bridgetown talks is vital meeting in the further progress of the amended restructuring option.

The Barbados meeting comes as Caribbean countries are being asked to contribute a total of US$5.4 million in emergency funding need to keep the airline in the sky. At the same time, 11 destinations have been given until Friday, March 15, to respond to the airline’s minimal revenue guarantee (MRG) proposals.

Gonsalves said that countries, including the four major shareholders –Antigua and Barbuda, Barbados, d Dominica and St. Vincent and the Grenadines – along with Grenada, have agreed to contribute to the US$5.4 million.

Barbados, which has the 116 weekly departures, the highest by LIAT, is being asked to contribute US$1.614 million, while Antigua and Barbuda, which has 69 departures, will contribute US$960,310.

Dominica, is being asked to contribute US$347,938 in light of its 25 weekly flights, St. Vincent and the Grenadines with 52 departures per week will contribute US$723,711 while Grenada, which has 35 LIAT departures per week, is being asked to contribute US$487,113.

Gonsalves told legislators that said these five countries constitute the “A Group” and that while no other government has come forward in the face of the crisis, the shareholder governments are targeting a further three, namely Guyana, St. Kitts and Nevis and St. Lucia, for contributions of US$292,280, US$389,691, and US$584,536, respectively.

Gonsalves told lawmakers that LIAT’s shareholder governments have asked the airlines to refine the US$5.4 million request.

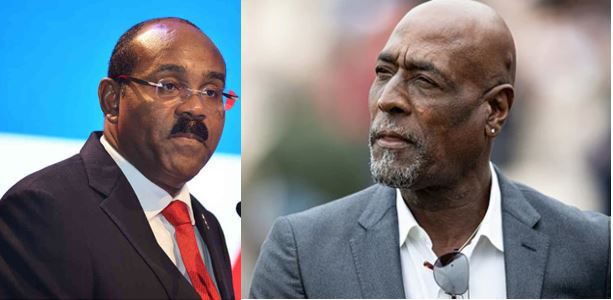

Monday’s ministerial statement came on the heels of the meeting here that was attended by Antigua and Barbuda and Barbados prime ministers, Gaston Browne and Mia Mottley.

Gonsalves told legislators that several other countries serviced by LIAT — including Trinidad and Tobago — are not included in the request because they have opposed, up front, putting in any emergency funding into the ailing airline.

But Gonsalves said that Caribbean Airlines, the national airline of Trinidad and Tobago, is scheduled to meet with LIAT regarding functional cooperation between both carriers.

Last month, Port of Spain said it would seek to help the cash-strapped regional airline reduce its financial burden by possibly entering into an agreement with CAL regarding the maintenance of its fleet.

“I have agreed to allow them to talk with CAL to see whether there is any economic benefit or possibilities for cooperation between CAL and LIAT from that standpoint to even a business cooperation, ‘ Prime Minister Dr. Keith Rowley told reporters in Port of Spain, adding “LIAT is expected to come to talk to CAL to see whether there’s any possibility of them doing business with CAL…which may relieve them of some of their expenses”.

Gonsalves said while St. Vincent and the Grenadines recorded 52 LIAT departures per week, several of those flights are underperforming, as is the case in every other destination, though some more than others.

Under and MRG model, it is likely that a few flights may be cut if the government is not prepared to fund them with a guarantee, Gonsalves told lawmakers.

For example, two flights from St. Lucia to St. Vincent have average passenger loads of 46 per cent. One of the flights from Trinidad has a 38 per cent average passenger load and Gonsalves said “maybe another air carrier, perhaps a small one registered in St. Vincent and the Grenadines, may fill the breach on the St. Lucia-St. Vincent.

“In short, there are possible, reconfigured options. In this respect, the regulatory authorities are urged to address expeditiously application by other airlines — third-tier airlines — for the various routes in a reconfigured regional air transport industry,” Gonsalves said, adding that theoretically, several countries have no quarrel with the MRG.

“If a country wants a particular flight and it is not viable financially for LIAT that country pays a guarantee for its operation, just like they do for the international carriers.”

He said that in the “evolving saga”, among the things that the management of LAIT has done is to send MRG letters to 11 destinations, namely: Antigua, Barbados, Dominica, Grenada, Guyana, St. Kitts, St. Lucia, St. Martin, St. Vincent, Tortola and Trinidad.

No MRG letters have been sent, as yet, to Martinique, Guadeloupe, St. Martin, and Puerto Rico, Gonsalves said, adding that the MRG would yield an estimated US$16 million annually but will not address LIAT existing debt to the Barbados-based Caribbean Development Bank.

The airline has been unable to service that debt and the shareholder governments have had to repay.

He said the MRG model, may, however, cause a reduction in the flight schedule, adding that he will chair the Barbados meeting.

Gonsalves said that Mottley on Saturday jokingly called the MRG “Mr Ralph Guarantee” and he told her that the MRGS means, “Mia, Ralph, Gaston and Skerrit” — referring to the four prime ministers of LIAT’s main shareholder nations.

“But the MRGs require the involvement of all countries served by LIAT,” Gonsalves told Parliament.