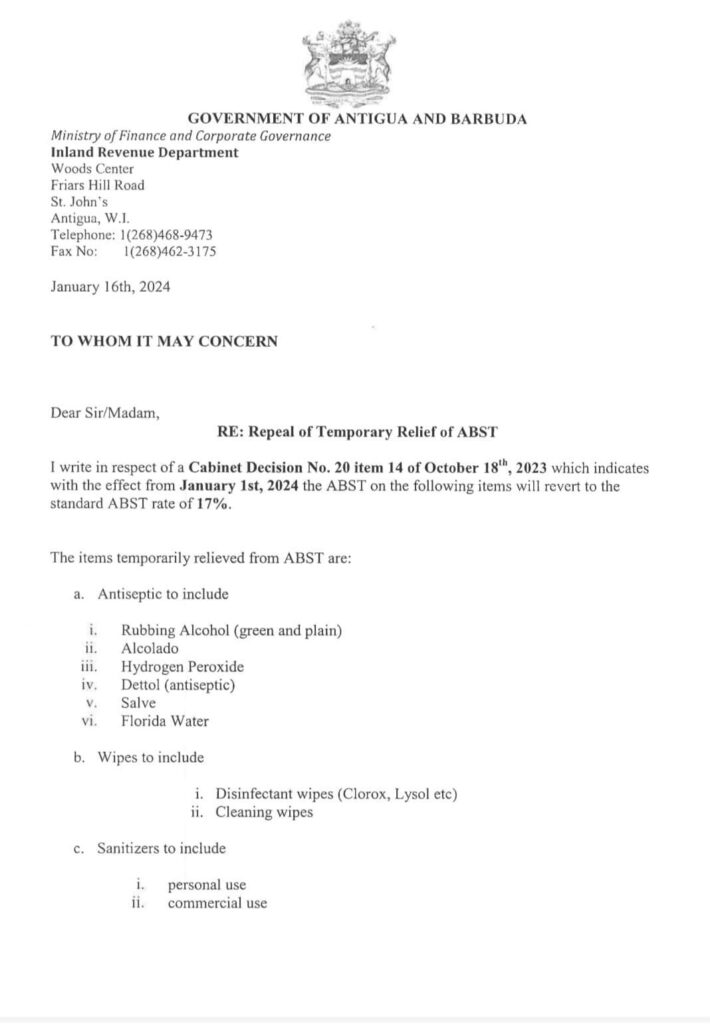

The Inland Revenue Department has issued a statement regarding the repeal of temporary relief on Antigua and Barbuda Sales Tax (ABST) for certain essential items. The decision, outlined in Cabinet Decision No. 20 item 14 of October 18′, 2023, comes into effect on January 1st, 2024, and will see the reinstatement of the standard ABST rate of 17% on specific products.

The items that were temporarily relieved from ABST, and will now revert to the standard rate, include a range of essential goods that gained relief during the past period. These items are categorized as follows:

1. Antiseptics:

- VI

- Rubbing Alcohol (green and plain)

- Alcolado

- Hydrogen Peroxide

- Dettol (antiseptic)

- Salve

- Florida Water

2. Wipes:

- Disinfectant wipes (Clorox, Lysol, etc.)

- Cleaning wipes

3. Sanitizers:

- Personal use

- Commercial use (in gel, foam, liquid, spray, etc.)

4. Toilet Paper and Paper Towel

5. Aloe Vera Gel

6. Vitamins:

- Vitamin C

- Multivitamins

The temporary relief on these items was introduced to support public health efforts during challenging times. However, with the expiration of the relief period, the Inland Revenue Department has decided to revert to the standard ABST rate on these essential goods.

The Commissioner of Inland Revenue, Calch. [Last Name], urged the public to take note of these changes and comply with the revised ABST rates. The announcement aims to ensure transparency and clarity for both consumers and businesses affected by the adjustment.

For any further inquiries or clarification, individuals and businesses are encouraged to reach out to the Inland Revenue Department for guidance. The department remains committed to providing assistance and information to the public as needed.

This decision aligns with ongoing efforts to balance economic considerations with public health concerns. The Inland Revenue Department acknowledges the importance of these essential items and assures the public that the decision is made with careful consideration of the overall well-being of the community.

About Inland Revenue Department: The Inland Revenue Department is responsible for administering and enforcing tax laws in Antigua and Barbuda. Committed to fair and transparent tax practices, the department plays a crucial role in revenue collection for the government.

Аdvеrtіѕе wіth thе most visited news site in Antigua and Barbuda ~ Wе оffеr fullу сuѕtоmіzаblе аnd flехіblе dіgіtаl mаrkеtіng расkаgеѕ. Yоur соntеnt іѕ dеlіvеrеd іnѕtаntlу tо thоuѕаndѕ оf uѕеrѕ іn Antigua аnd аbrоаd via our One Signal push notifications! Соntасt uѕ аt [email protected].

———————————————————————

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

Make a donation to help support ABN, via PayPal: [email protected]. Follow Antigua Breaking News on X, formerly Twitter @ABNAntigua, and Instgram @AntiguaBreakingNews and on Facebook. Send us a message on WhatsApp at 1-268-779-3189 or email us at [email protected].