After hours of debate from MPs on both sides of the Lower House, parliamentarians voted to consolidate government loans amounting to $127 million under the Loan Borrowing from Antigua Commercial Bank Bill 2020.

The loan will consolidate all existing public sector borrowing with a long-term bond, and a $5 million overdraft facility at the Antigua Commercial Bank (ACB).

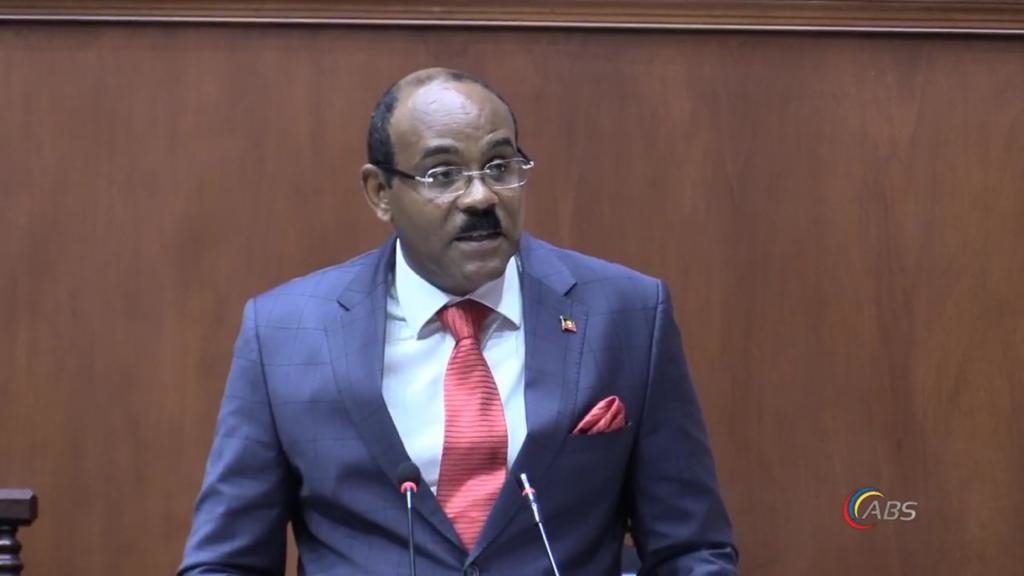

The government has negotiated for a payback amount of $928,000 monthly at an interest rate of 6.25 per cent over a 20-year period. However, Prime Minister Gaston Browne said the interest on the overdraft which is currently at 11 per cent will have to be reduced further.

“I notice they are charging an interest rate of 11 percent which is too high and I’ll be asking the finance officials to speak to the bank and to get this under 10 percent,” he told parliamentarians on Tuesday.

“The Board of Directors of ACB ought to reconsider their position and give serious consideration to reducing the interest rate to 9 percent even 8 per cent if they can,” he added.

Meanwhile, government MPs came down hard on Leader of the Opposition in Parliament, Jamale Pringle, who insisted that the government enter into an agreement with the International Monetary Fund (IMF) as opposed to consolidating its debt.

He believed it to be the best option in order for government to meet its obligations and to ensure that pensioners were paid their Social Security benefits on time.

Pringle, who clearly stated his objection to the Bill, also said that by taking such a large loan from the local bank, the government would be putting ACB “under pressure” and would reduce the amount of money that that bank would be able to loan to other borrowers.

His comments triggered an hours-long debate with Minister of State in the Ministry of Finance and Corporate Governance, Lennox Weston highlighting his lack of understanding of how the economy works.

“The IMF is the institution of last resort. When you’re bankrupt and nobody will lend you money, you go to the IMF on your hands and knees to save your country because, normally, you don’t have a penny to pay your bills and so you have no choice,” the minister said.

According to Weston, “when you have declared bankruptcy as an individual or a country, the reputational damage is massive. Nobody does business with a bankrupt country, no investor comes to a bankrupt country, all your financial systems are under threat so that when you go to IMF it is not only about the interest rate they will charge you. The biggest cost of IMF is the reputational damage of driving private investment in your economy because people know you are a failed state with no capacity”.

The prime minister also called Pringle’s argument “irrational” and noted that 90 per cent of the loans being consolidated were incurred by the United Progressive Party administration during its 10-year term in office. — Observer Media