A former finance minister is warning Grenada and other Caribbean countries that the controversial Citizenship by Investment Programme (CBI) “will cease to exist in a very short time.”

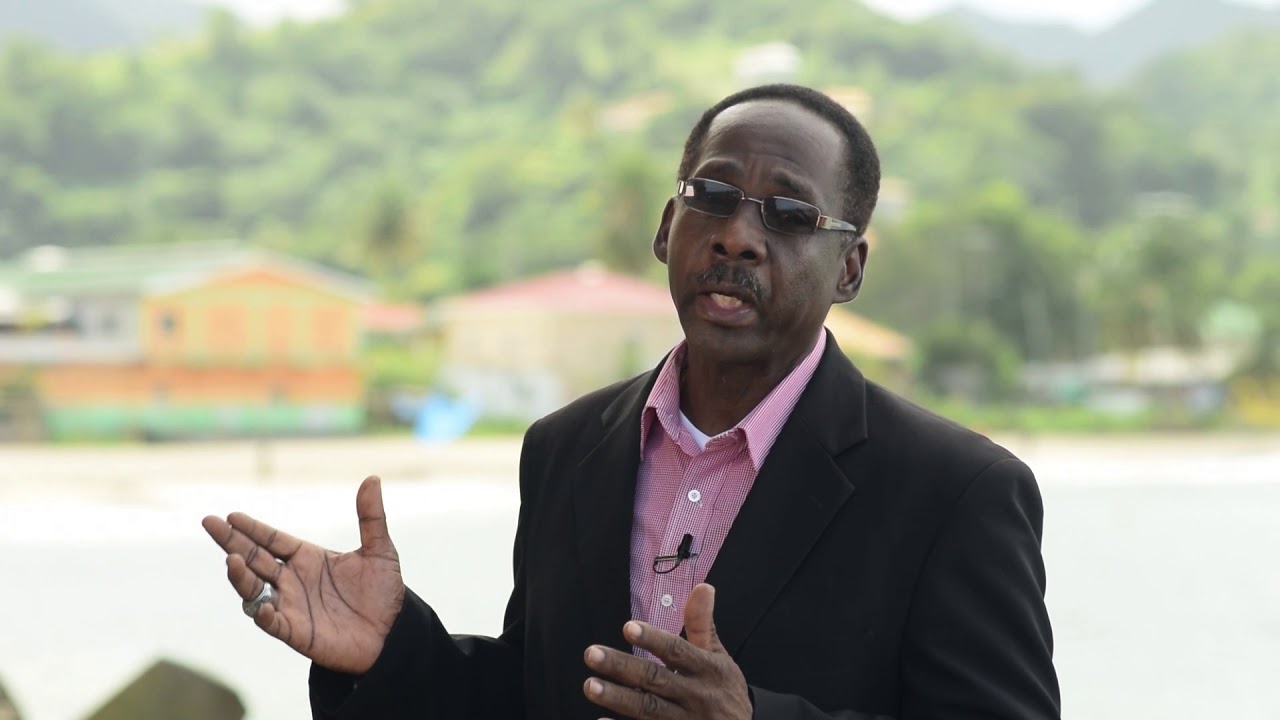

Anthony Boatswain told legislators that the CBI, under which Caribbean countries grant citizenship to foreign investors in return for making a substantial investment in the socio-economic development of the islands, is coming under increased international pressure from the more developed countries as well as the competition among the regional countries themselves.

“That threat is coming to us from two different angles, first we have the regional CBI countries or countries that are involved in the CBI programmes but what we have is a better thy neighbour policy, each one trying to outdo the other in other to get favour in the market,” said Boatswain who claim that this practice is a serious threat that will result in OECD (Organisation of Economic Cooperation and Development) countries expressing concerns,” said Boatswain, who until March last year was a senior member of the Keith Mitchell administration.

““As we lower the bar chances are we might get involved in other activities that they will cite as not been their interest and that programme Mr Speaker will also come to an end,” said Boatswain, as he made his contribution to the amendment to the CBI legislation

The amendment makes it easier for the siblings and dependents of applicants to become a citizen and receive passports under the programme.

Boatswain, who opted not to accept a ministerial position following the re-election of the New National Party (NNP) in the March 13 general election last year, told legislators what is needed is not competition among Caribbean countries.

“ The countries should be involved in harmonising their policies with regards to the CBI, so investors cannot play one against the other but we are falling victim to that and we are on a race as to who can outbid each other,” said Boatswain, a former minister of trade and planning.

He said regional governments should be cognizant of the global environment and recognise that over the past years or so we had to recognise the confluence of forces of how small dependent developing economies exist within the global framework.

“Whether the relationship is good or dismantle, they determine what is best for us, it has always been in their interest, they determine what is not good for us,” said Boatswain, recalling how Europe and other developed countries had used their policies to kill off programmes that were working in the interest of the region, such as the preferential treatment “for our bananas and the offshore banking sectors”.

He warned that the present global environment had the potential to further cause damage to the economies of the Caribbean.