Economic integration continues to be at the forefront of the OECS’s regional integration initiatives for the Economic Union. To this end, a specially funded cohort of trade and legal practitioners from the OECS region benefited from the introduction of a short course on the Caribbean Court of Justice (CCJ).

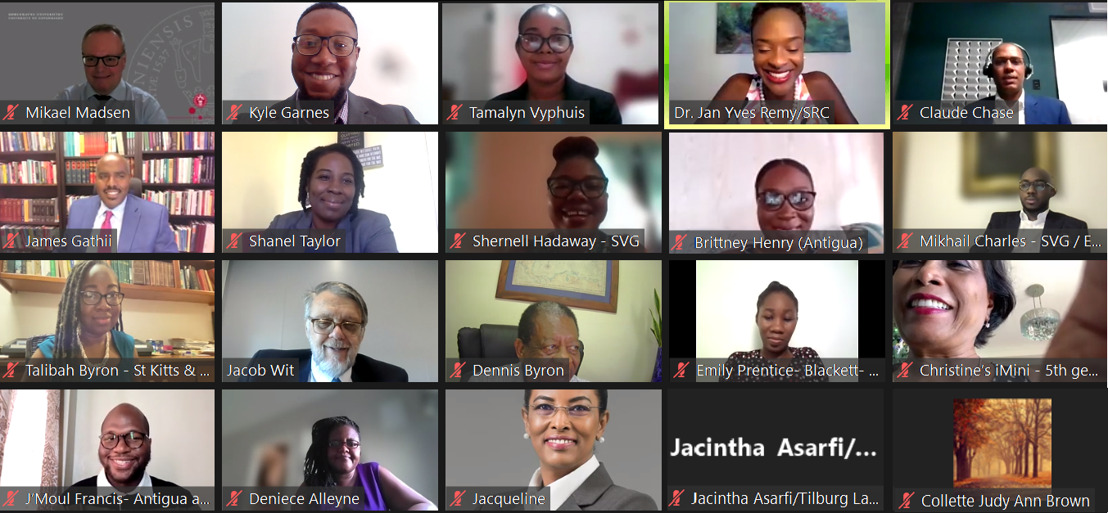

On Monday January 10, 2022, the OECS Commission in collaboration with the Shridath Ramphal Centre (UWI-SRC) officially launched the short course on Caribbean Community Law and the Caribbean Court of Justice.

The course was funded under the OECS – ACP TradeCom II Programme and ran from January 10-14, 2022. Twelve (12) practitioners across the six (6) OECS Protocol Member States completed the course.

The virtual training aimed to sensitize and enhance the knowledge of legal practitioners on substantive and procedural Caribbean Community Law, the rules, and procedures of the CCJ in its original jurisdiction, and the case law developed by the Court thereunder. As a result of this training, the increased knowledge in the region of Caribbean Community Law should lead to an increase in the caseload of the CCJ, leading to a quicker pace of development of the legal framework for economic integration in the region.

The course familiarized the participants with the institutional and governance components of CARICOM, which plays an integral role in the operation of the legal framework governing economic integration. Participants were also provided in-depth knowledge of the original jurisdiction of the CCJ; examined select aspects of procedural Community Law and examined crosscutting/thematic issues arising from the CCJ’s adjudication of disputes thus far in its original jurisdiction.

The course featured the CCJ President, the Honourable Justice Adrian Saunders, as well as various CCJ practitioners and experts such as Dr. David Berry, Kurt Da Silva, Dr. Corlita Babb, Simone Mayhew, Gladys Young, Dr. Kathy Ann Brown, Dr. Chantal Ononaiwu, Sir Dennis Byron, Hon. Mme. Justice Maureen Rajnauth-Lee, Hans Lim A Po, Professor Mikael Madsen, Hon. Mr. Justice Jacob Witt, Professor James Gathii and Claude Chase.

This is one of seven (7) short courses that the OECS Commission in collaboration with the UWI-SRC will be offering over the coming months. In December 2021, trade and legal practitioners in the OECS benefited from a short course on Competition Law.