Although grappling with challenges related to climate change; wide fiscal deficits and high public debt; as well as high unemployment, the Caribbean Development Bank (CDB) today projected that the Region’s economy is expected to grow by 2 per cent in 2019.

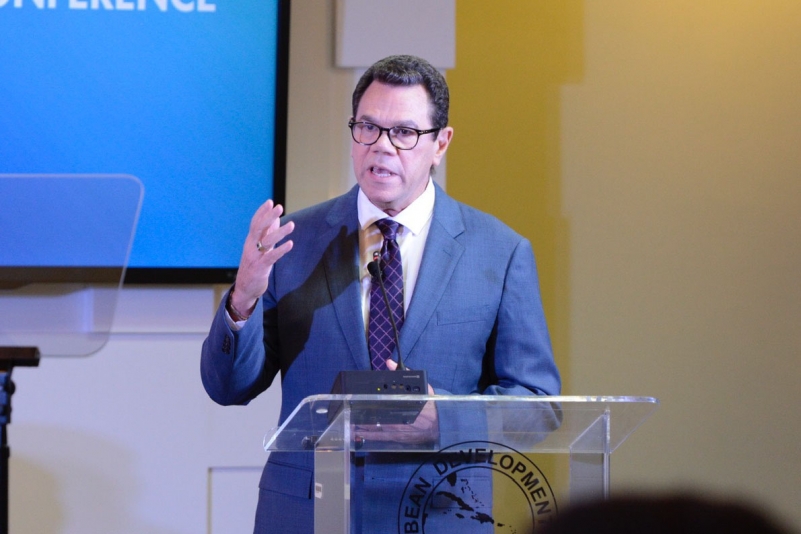

CDB President, Dr. Warren Smith shared the Bank’s forecast at its Annual News Conference, held in Barbados.

“Despite projections of deceleration in global economic activity, the 2019 economic outlook for our Borrowing Member Countries is positive. CDB is projecting that real GDP growth will be around two per cent, as construction, tourism, and the extractive industries such as gold and oil are expected to expand,” Smith said.

The President outlined that the majority of the Bank’s Borrowing Members recorded economic growth averaging 1.9 per cent, compared with 0.5 per cent in 2017. He noted that the fastest-growing regional economies of 2018 were Antigua and Barbuda, Grenada, Guyana.

Grenada’s region-leading performance of 5.2 per cent continued a five-year positive trend as that country continues to experience the financial growth coming out of its home-grown economic reform programme.

Reconstruction efforts led the way to 3.5 per cent growth in Antigua and Barbuda, as the country rebuilt and recovered following the passage of Hurricane Irma on Barbuda in 2017.

Growth in Guyana, recorded at 3.4 per cent, was mainly due to increased construction activity, in advance of the first commercial production of oil in 2020.

Conversely, in his review, Smith noted that in Anguilla and the British Virgin Islands, the devastating 2017 hurricane season stymied economic growth as visitor arrivals declined sharply – by 40 per cent and 50 per cent respectively, due to extensive damage to hotel stock. A fall in construction activity as well as the impact of the fiscal consolidation led to economic contraction in Barbados, despite a modest increase in tourist arrivals.

In the face of these mixed fortunes, the President called for a dual strategy of resilience-building and transformation to accelerate growth in the Region and to ensure that economic gains can be sustainable.

He highlighted the Bank’s ongoing work and partnerships to build climate resilience. These include an agreement with the United Kingdom’s Department for International Development which added GBP30 mn to the United Kingdom Caribbean Infrastructure Fund for reconstruction in Barbuda and Dominica.

CDB will also administer the Dominica Disaster Recover and Resilience Fund established and funded by the Government of Canada, which will enhance post-disaster response, build more climate resilient schools and empower communities across the country.

The Bank also signed an agreement with the Green Climate Fund which will facilitate more climate finance projects in the Region.

Calling for transformation to address the increasingly complex challenges Caribbean countries faced, Smith noted that the process has already been taking shape.

“As our institution approaches its 50th year, digital transformation and innovation have moved to the top of our agenda. This means leveraging technology to deliver higher-quality service and greater value to our members and partners. It is important that CDB remains the development partner that Caribbean Governments turn to first for solutions—whether they be funding, advice or technical assistance,” he said.