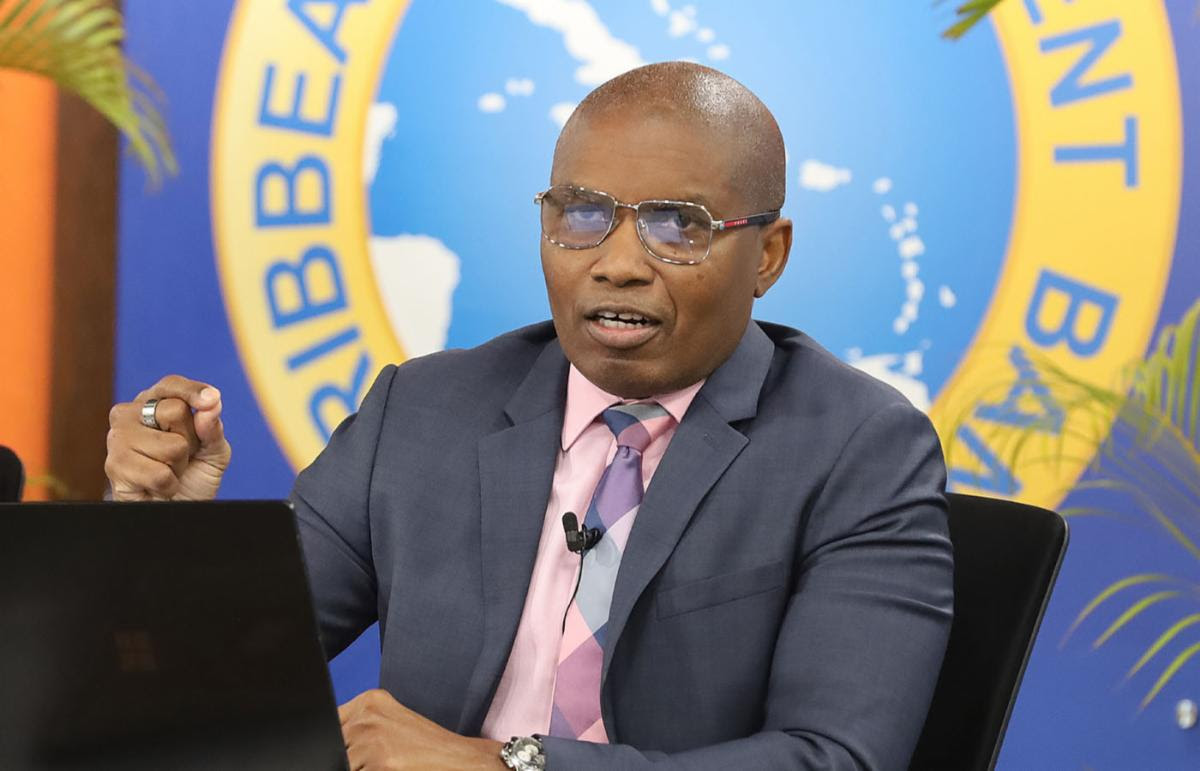

The majority of Caribbean economies are on the rebound says Director of Economics at the Caribbean Development Bank (CDB) Ian Durant.

CLICK HERE TO GET ON THE ABN WHATSAPP

Speaking at the Bank’s Annual News Conference on February 20, 2024, the Bank’s chief economist stated that “CDB forecasts an average growth rate of 8.6% for its 19 Borrowing Member Countries in 2024, largely attributable to increased oil production in Guyana and the continued expansion of the tourism industry. Excluding Guyana, this growth projection falls to 2.3%, a moderation from the estimated growth of 2.5% in 2023, which aligns with the broader trends of slowing, below-average global growth and the ongoing normalisation of economic conditions in the Caribbean.”

Delivering a presentation focused on “Current and Future Requisites For Prosperity”, Durant highlighted the mostly favourable performance of the Bank’s 19 Borrowing Members in 2023. However, he also indicated that Haiti remained the exception to the current trend owing to continued instability and high inflation.

The Economics Director also projected that the positive trajectory for 18 of the Bank’s 19 clients is anticipated to continue into 2024. “Despite having to navigate this challenging external environment, Caribbean economies continued to rebound from the COVID-19 shock, with an average growth rate of 6.7% in 2023.” Tourism remained a key driver of the regional economic performance, with service-exporting economies growing at an average of 2.4%. “These economies benefitted from robust demand from major source markets and by the end of 2023, 11 countries had overtaken pre-pandemic output levels.”

Although optimistic, the projections are susceptible to various risks including sluggish global growth, persistent high inflation, challenges linked to climate change, and natural disasters, which can all undermine economic performance. While citing this positive trajectory, and the regional financial institution’s commitment to providing more resources to enable greater resilience, he also identified some requisites for achieving resilient prosperity in the region.

The requirements included adequate, climate-resilient social and economic infrastructure, improving the institutional frameworks within which businesses operate, especially through digitalization and the adoption of artificial intelligence. The Economist also recommended expanding the human resource base and reducing skills gaps, enabling greater sustainable energy to boost energy security and reduce energy costs. In addition, he stressed the improvement of logistics quality to facilitate intra-regional trade, which can develop regional value chains, reduce import dependence, and enhance food security.

Durant further advised governments that “at this juncture, the focus of fiscal policy is to strike the appropriate balance between securing fiscal sustainability and facilitating growth and development. Making the necessary investments in pursuit of resilient prosperity will require greater access to adequate and affordable financing, so as to not compromise debt sustainability efforts.”

He added, “Raising potential output and building economic resilience over the medium to long term will require reducing high export concentration by raising competitiveness through increased productivity and lower production costs.”

CLICK HERE TO GET ON THE ABN WHATSAPP

Аdvеrtіѕе wіth thе most visited news site in Antigua and Barbuda ~ Wе оffеr fullу сuѕtоmіzаblе аnd flехіblе dіgіtаl mаrkеtіng расkаgеѕ. Yоur соntеnt іѕ dеlіvеrеd іnѕtаntlу tо thоuѕаndѕ оf uѕеrѕ іn Antigua аnd аbrоаd via our One Signal push notifications! Соntасt uѕ аt [email protected].

———————————————————————

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

Make a donation to help support ABN, via PayPal: [email protected]. Follow Antigua Breaking News on X, formerly Twitter @ABNAntigua, and Instgram @AntiguaBreakingNews and on Facebook. Send us a message on WhatsApp at 1-268-779-3189 or email us at [email protected].