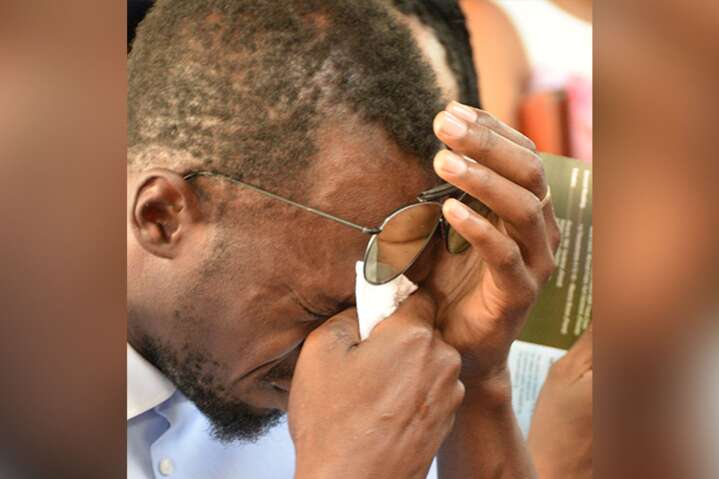

Jamaican sprint legend Usain Bolt is staring at a wipeout of his heavy investment at Stocks and Securities Limited (SSL) and is now fearing that the monies, which he had hoped to access in his later years, will likely not be recovered.

A Jamaica Observer source said the information was delivered to Bolt’s management team last week just before the company went public about a massive fraud that sources say amounts to more than $1.2 billion.

Bolt is among more than 30 people whose investments at SSL are believed to have been fleeced by a wealth advisor.

Last Thursday SSL issued a statement saying that it had “become aware of fraudulent activity by a former employee of the company”.

The company said that following initial internal investigations it “referred the matter to the relevant law enforcement authorities to facilitate a thorough and complete examination of all aspects of the matter”. Added the company, “To ensure this, we have taken steps to secure those assets and strengthened internal protocols to detect suspicious activity in the shortest time possible.” The company also said it would “continue to liaise and cooperate fully with law enforcement throughout this investigation and ensure that the responsible party faces the full consequence of the law”.

At the weekend the Observer source said SSL was aware of the fraud since August; however, the employee suspected of involvement was still employed to the company up to last Wednesday.

That was the same day that Bolt’s team met with SSL representatives after requesting a meeting last December following the Olympian’s yearly review of his financial portfolio, at which he point he had noticed the discrepancy.

After Bolt’s team brought the matter to the attention of SSL, the company revealed that it had been doing an investigation into other matters to which the employee allegedly “confessed”, but until then the company was not aware that Bolt had also been affected.

Bolt, the source said, opened the account in 2012 and never made a withdrawal. He is said to have invested just under US$10 million. However, the source stated that only US$2,000 remains in the account.

The source also suggested that the magnitude of the fraud involved more than one person and the authorities are looking at that possibility. Efforts by the Observer over the weekend to confirm this information with the company were not successful.

Late last Thursday the Financial Services Commission (FSC) said it has issued directions to SSL barring it from engaging in sales or trading of assets without the permission of the FSC.

“These directions are a supervisory tool to allow the FSC to engage an entity in a process of enhanced oversight,” the regulator said.

“In the case of SSL, this enhanced oversight reflects the need for the FSC to have a full view of the integrity of the transactions being conducted, including the movement of funds and of securities into and out of SSL.”

The FSC also said it will continue its investigations into matters related to SSL.

SOURCE: Jamaica Observer

Make a donation to help support ABN, via PayPal: [email protected]. Follow Antigua Breaking News on Twitter @ABNAntigua and Instgram @AntiguaBreakingNews and on Facebook. Send us a message on WhatsApp at 1-868-704-9864 or email us at [email protected]

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.

CLICK HERE TO JOIN OUR WHATSAPP GROUP FOR NEWS UPDATES.