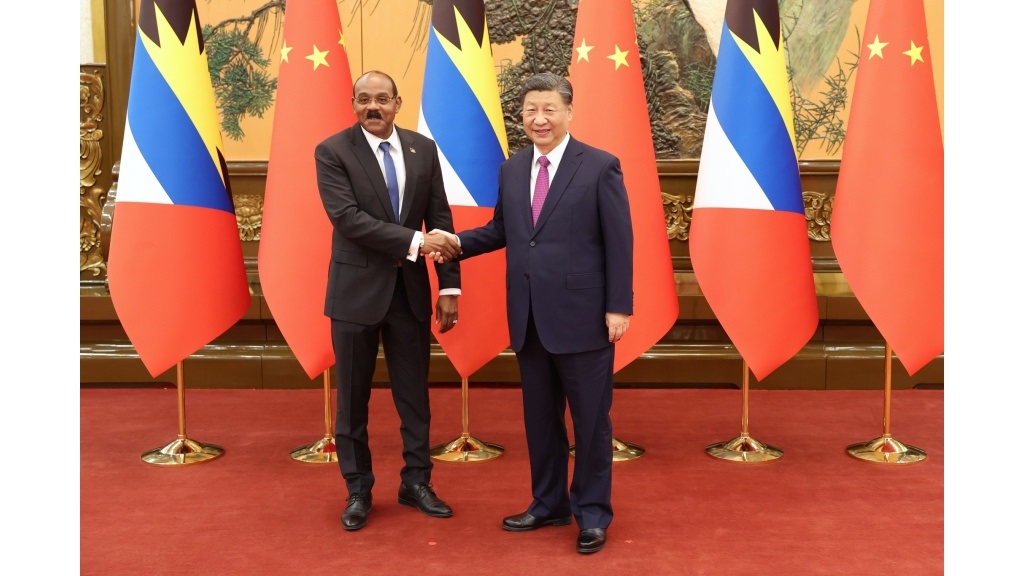

Prime Minister Dr Terrance Drew has applauded the leaders of Antigua & Barbuda, the Commonwealth of Dominica, and Grenada for joining forces with the Federation of St Kitts and Nevis in executing an historic Memorandum of Agreement to strengthen the Citizenship By Investment Programmes (CBIPs) in those OECS Member States.

CLICK HERE TO GET ON THE ABN WHATSAPP

Prime Minister Drew, currently Chairman of the OECS, championed the move, which seeks to assure the international community that this group of four OECS Member States which operate CBIPs will exchange best practices, due diligence processes, and intelligence related to potential security or compliance risks. The purpose of the Memorandum of Agreement is to provide a framework for cooperation and information sharing among the four OECS Member States in relation to their CBIPs.

Prime Minister Drew has commented that “the four small island developing states who signed this Memorandum have committed to increase and harmonize the minimum investment threshold of their CBIPs to an investment sum of at least US$200,000 no later than June 30, 2024, and more importantly, to bring an end to ‘underselling’, a scourge on the CBI Industry in the recent past. We have therefore agreed that the minimum investment thresholds for our CBIPs shall represent the actual amount of funds received and applied towards an applicant’s qualification under our respective CBIPs, and not the gross amount of funds paid by an applicant from which deductions, including the payment of commissions, are made.”

“I commend my fellow Prime Ministers for recognizing that CBIPs are too important to our respective economies to act irresponsibly in their operations. This move will show the world that our four nations are responsible and serious about operating investment migration programmes that respect the rule of law, are sustainable and do not offend the interests of our brothers and sisters in the international community,” said Prime Minister Drew.

The Memorandum of Agreement, dated March 20, 2024, also sees the four nations agreeing to:

1. share information on CBIP applicants;

2. implement enhanced transparency measures such as the disclosure of funds received by CBIPs, the use of the proceeds of CBIs and to conduct independent financial and operational audits to assess CBIs compliance with best practice standards;

3. assign or establish a regional competent authority to set standards in accordance with international requirements and best practices and to regulate the CBIPs;

4. establish common standards to manage the communications and promotion of the CBIPs;

5. establish common standards for the regulation of agents operating in the CBIPs; and

6. facilitate joint training programs and capacity-building initiatives for their respective officials and agencies involved in the administration of CBIPs.

The Memorandum of Agreement supplements the six principles agreed between all CBIP operating OECS Member States and the United States of America in March 2023. The Federation of St Kitts and Nevis, which has been operating a CBIP since 1984, made significant advancements to its CBIP Regulations in December 2022 and July 2023. CBIPs in the OECS had become the target of international scrutiny between 2017 and 2022 during which there was a ‘race to the bottom’ with respect to investment options.

By July 2023, less than a year into Prime Minister Drew’s tenure, the minimum investment option of the St Kitts and Nevis CBIP was increased to US$250,000, ‘underselling’ was eliminated, and numerous other good governance structures were implemented. These measures have been commended by international partners and CBIP stakeholders.

CLICK HERE TO GET ON THE ABN WHATSAPP

Аdvеrtіѕе wіth thе most visited news site in Antigua and Barbuda ~ Wе оffеr fullу сuѕtоmіzаblе аnd flехіblе dіgіtаl mаrkеtіng расkаgеѕ. Yоur соntеnt іѕ dеlіvеrеd іnѕtаntlу tо thоuѕаndѕ оf uѕеrѕ іn Antigua аnd аbrоаd via our One Signal push notifications! Соntасt uѕ аt [email protected].

———————————————————————

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

CLICK HERE TO GET ON THE ABN WHATSAPP

Make a donation to help support ABN, via PayPal: [email protected]. Follow Antigua Breaking News on X, formerly Twitter @ABNAntigua, and Instgram @AntiguaBreakingNews and on Facebook. Send us a message on WhatsApp at 1-268-779-3189 or email us at [email protected].